While UK stocks have surged since the general election due to the fact that it now looks like Prime Minister Boris Johnson will actually “get Brexit done“, we should not forget that Brexit remains a risk to the UK economy. Given that the EU is the UK’s largest trading partner, leaving the trade bloc could have negative ramifications for economic growth.

If you’re an investor, now could be a good time to think about your risk exposure, given the uncertainty associated with our EU exit. With that in mind, here are two FTSE 100 dividend stocks I’d buy to hedge my portfolio against Brexit risks.

Diageo

One of the first FTSE 100 stocks I’d turn to for protection is alcoholic drinks champion Diageo (LSE: DGE), which owns a number of well-known spirits brands including Johnnie Walker, Tanqueray, and Smirnoff. I believe it has a number of attributes that could help it outperform in the event of an economic downturn in the UK.

Should you invest £1,000 in Mony Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Mony Group Plc made the list?

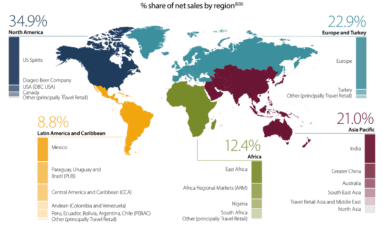

For starters, it’s a global company that sells its products in more than 180 countries around the world. So what happens to the UK economy in the years ahead is largely irrelevant for the company. And, if the pound was to fall, its earnings would actually rise because it generates such a large proportion of its sales internationally.

Source: Diageo 2019 Annual Report

Second, it’s a reliable dividend payer (21 consecutive increases now) and its yield, which is currently around 2.3%, could provide protection against an interest rate cut. When interest rates fall, dividend stocks generally become more attractive because of their higher yields.

Finally, Diageo is a proven performer with a fantastic long-term track record. In the event of a downturn, I can see investors gravitating towards the stock for safety.

Diageo shares currently trade on a forward-looking P/E ratio of 23.4. That’s not a bargain valuation. However, given the stock’s high-quality attributes, I think the premium is justified.

Reckitt Benckiser

Another FTSE 100 dividend stock I’d consider for Brexit protection is consumer goods giant Reckitt Benckiser (LSE: RB). It owns a world-class portfolio of trusted health and hygiene brands such as Nurofen, Dettol, and Mucinex.

Like Diageo, Reckitt is a truly global player – its brands are available in over 200 countries. In 2018, revenue from the UK amounted to under 6% of its total, meaning that the group is largely insulated from risks to the UK economy. Due to its international exposure, its earnings will receive a boost if sterling declines.

Reckitt is also a reliable dividend payer. It has notched up 16 consecutive dividend increases now and the stock’s yield currently stands at about 2.8%, which is attractive enough in today’s low-interest-rate environment. An interest rate cut would make this yield even more appealing.

The shares currently trade on a forward-looking P/E ratio of 18.7. I see that as good value, given the company’s defensive characteristics and long-term track record of generating shareholder wealth. I believe the stock is a good ‘Brexit buy’ right now.